Financial targets

Wästbygg Group has three overarching goals for the business – sustainable business, long-term growth and good profitability.

SUSTAINABLE BUSINESS

Sustainable business is measured by reducing the climate impact of our operations and by ensuring that 80 percent of the company’s order backlog is classified as green in accordance with our green framework.

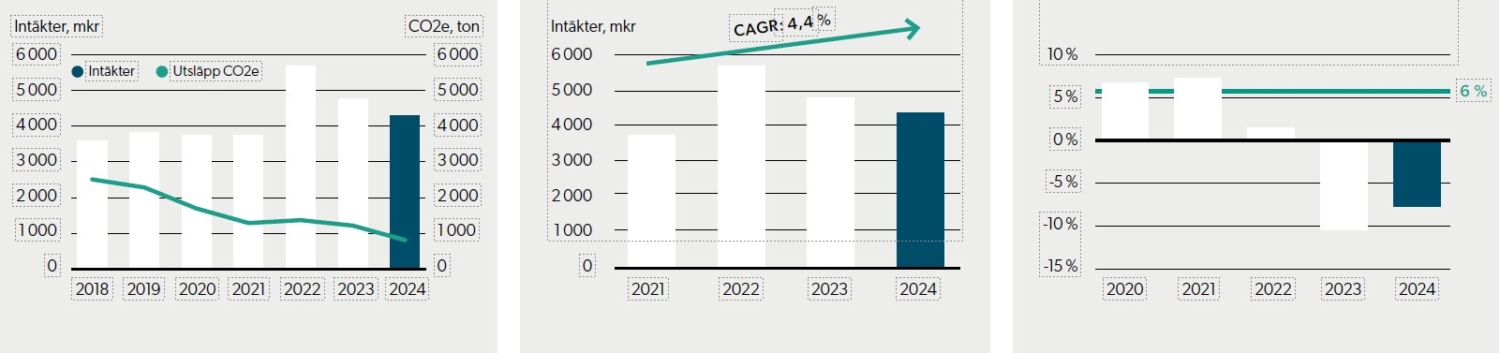

2024 was the final year in which we monitored climate impact in relation to our previous target of achieving fossil-free operations in electricity, heating, transport and waste by 2030. Since measurements began in 2018, our climate footprint within these areas has decreased steadily, and in 2024 we reached a result of 862 tonnes of CO₂e, representing a 26 percent reduction compared with the previous year.

From 2025 onwards, we will measure our performance against the significantly more comprehensive target formulated at the end of 2023: by 2045 at the latest, Wästbygg Group shall achieve climate neutrality across its value chain.

LONG-TERM GROWTH

Wästbygg Group’s growth target is for revenues to increase by ten percent annually over time. Growth is therefore measured over the most recent three-year period, based on the year immediately preceding the relevant three-year period. The key metric used is CAGR – Compound Annual Growth Rate.

Growth must always be achieved with due consideration for sound profitability. There is no inherent value in volume growth alone; the growth target must go hand in hand with a healthy operating margin and strong equity ratio.

In 2022, a significant increase in revenues was reported compared with previous years. Due to the weaker economic climate in 2023 and 2024, revenues declined but remained above the level reported for 2021, resulting in a CAGR of 4.4 percent for the period measured.

STRONG PROFITABILITY

Profitability is measured using the operating margin, defined as earnings before interest and taxes (EBIT) in relation to revenues. Over the long term, the operating margin should exceed five percent, reflecting stable profitability in Wästbygg Group’s operations.

For both 2023 and 2024, we reported negative results due to the weaker economic environment. Cost increases and rising interest rates have had a severe impact on the construction industry as a whole, and particularly on the residential segment. As a result, volumes within the Residential business area have declined significantly, while revenues have also decreased slightly within Commercial.

Deteriorating margins due to increased costs have led to impairments in certain projects. In addition, several bankruptcies among subcontractors at critical stages have had a major impact on results, which were further burdened by restructuring costs related to workforce reductions and the closures of the offices in Solna and Copenhagen carried out during the year.